Choosing the right Amazon product research tool can determine whether you launch a profitable product – or waste months chasing misleading data. While dozens of tools promise “winning products”, three platforms consistently dominate serious seller conversations in the US market: Helium 10, Jungle Scout, and AMZScout.

Choosing the right product research tool is essential once you’ve learned how to find and validate product ideas. If you need help with the foundational steps before tool selection, start with our guide on how to find profitable products on Amazon or Amazon Seller Guides.

This guide goes beyond surface-level feature lists. Drawing on real seller workflows, data accuracy considerations, and practical use cases, we compare Helium 10 vs Jungle Scout vs AMZScout to help you decide which tool actually fits your Amazon business model in 2026.

Why Product Research Tools Matter More Than Ever

Amazon’s marketplace is no longer forgiving. Saturated niches, rising PPC costs, and sophisticated competitors mean gut instinct is no longer enough.

A reliable product research tool helps you:

- Validate real customer demand (not hype)

- Estimate monthly sales and revenue with confidence

- Identify over-saturated vs under-served niches

- Analyze competitor pricing, reviews, and listing strength

- Reduce launch risk before investing in inventory

However, not all tools are built for the same type of seller. That’s where most comparisons fall short.

These databases and keyword platforms help you uncover high-potential ideas – a critical step described in detail in our guide on how to find your first product to sell on Amazon.

Evaluation Criteria (How We Compared These Tools)

To avoid shallow or promotional analysis, this comparison is based on:

- Data accuracy & reliability (sales estimates vs real outcomes)

- Depth of research features (not just product discovery)

- Usability for US-based sellers

- Scalability (beginner → advanced brand)

- Value for money based on real workflows

- Transparency in metrics and assumptions

While tools provide data, you still need the right product criteria to interpret results. See our guide on what makes a winning product to sharpen your filters.

Helium 10: The Most Comprehensive Amazon Research Suite

Best for: Advanced sellers, private label brands, and data-driven operators

Strength: All-in-one ecosystem with deep analytics

What Helium 10 Does Exceptionally Well

Helium 10 is not just a product research tool – it’s a full Amazon business operating system. Its strength lies in how multiple tools connect into a single workflow.

Key research features include:

- Black Box – Advanced product discovery with granular filters (price, revenue, review velocity, fulfillment type)

- Xray – Chrome extension for instant niche validation

- Trendster – Seasonal demand and historical trend analysis

- Profitability Calculator – Realistic FBA fee breakdowns

What sets Helium 10 apart is data triangulation. You’re rarely relying on one metric alone. For example, sellers can cross-check estimated revenue, search volume, and historical demand before making inventory decisions.

Limitations to Consider

- Interface can feel overwhelming for beginners

- Higher price point compared to competitors

- Overkill for sellers only doing basic wholesale or arbitrage

Verdict on Helium 10

If you’re building a long-term Amazon brand, Helium 10 offers the deepest insight and best long-term value. It’s particularly strong for sellers who want confidence before committing capital.

For a detailed breakdown of features and pricing, see our full Helium10 review.

Jungle Scout: The Gold Standard for Beginners and Product Validation

Best for: New sellers, first-product launches, educators

Strength: Simplicity, clean UI, and intuitive metrics

Why Jungle Scout Is Still So Popular

Jungle Scout earned its reputation by making product research accessible and understandable. It’s often the first serious tool new US sellers use – and for good reason.

Standout features include:

- Product Database – Fast niche scanning with clean filters

- Opportunity Finder – Demand vs competition scoring

- Sales Estimator – Easy-to-interpret monthly estimates

- Supplier Database – Useful for early sourcing ideas

Jungle Scout excels at reducing analysis paralysis. Instead of overwhelming users with data, it highlights what matters most when validating a first product.

Where Jungle Scout Falls Short

- Less advanced keyword and trend analysis than Helium 10

- Limited customization for power users

- Fewer tools beyond product discovery and validation

Verdict on Jungle Scout

Jungle Scout remains one of the best tools for launching your first Amazon product. If you value clarity over complexity and want to avoid rookie mistakes, it’s an excellent starting point.

AMZScout: Budget-Friendly Research with Solid Core Data

Best for: Budget-conscious sellers, testers, side hustlers

Strength: Affordable access to core research metrics

What AMZScout Gets Right

AMZScout focuses on the essentials: product demand, competition, and pricing – without the premium cost.

Core features include:

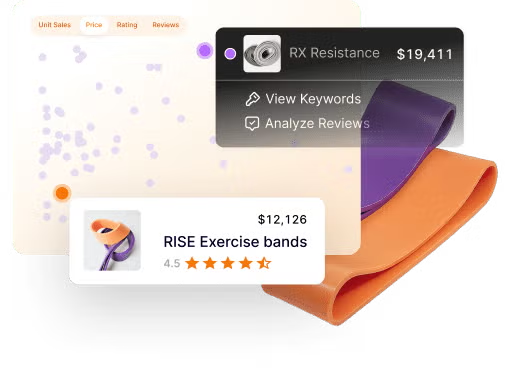

- Product Database and Chrome Extension

- Sales and revenue estimates

- Basic keyword insights

- Competitive analysis metrics

For sellers testing Amazon as a side business or validating ideas before upgrading tools, AMZScout provides surprisingly reliable data at a lower price point.

Trade-Offs to Know

- Fewer advanced analytics and integrations

- Limited ecosystem compared to Helium 10

- Less robust support and education resources

Verdict on AMZScout

AMZScout is ideal if you want accurate basics without a large monthly commitment. It’s not designed for scaling brands – but it’s honest, functional, and cost-effective.

If you’d like more insight into data accuracy and niche scoring, check out our AMZScout review.

Side-by-Side Comparison Summary

| Feature | Helium 10 | Jungle Scout | AMZScout |

|---|---|---|---|

| Best For | Advanced sellers | Beginners | Budget users |

| Data Depth | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Ease of Use | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Keyword Research | Advanced | Moderate | Basic |

| Trend Analysis | Yes | Limited | No |

| Pricing Tier | High | Medium | Low |

Which Tool Is Best for You?

Choose Helium 10 if:

- You plan to build a long-term Amazon brand

- You rely heavily on data before investing

- You want one platform for research, keywords, and optimization

Choose Jungle Scout if:

- You’re launching your first product

- You want clear signals without complexity

- You value simplicity and speed

Choose AMZScout if:

- You’re testing Amazon with minimal upfront cost

- You need basic validation, not enterprise analytics

- You prefer lean tools over feature-heavy platforms

Once you uncover potential opportunities with these tools, the next step is to validate product ideas before investing rather than rely solely on data.

Expert Insight from SwanseaAirport

At SwanseaAirport, we’ve reviewed dozens of Amazon tools across private label, wholesale, and Walmart sellers. One consistent finding stands out:

The best product research tool is the one that matches your stage – not the one with the most features.

Many failed launches come not from bad tools, but from using advanced tools too early or basic tools too long. Smart sellers upgrade their stack as their business matures.

Final Thoughts: No Tool Replaces Judgment

Helium 10, Jungle Scout, and AMZScout all provide valuable insights – but none guarantee success. Real profitability comes from combining data with market intuition, customer understanding, and disciplined execution.

Before leveraging advanced tools, make sure you’re grounded in the basics – see our guide on how to start selling on Amazon in 2026.

If this were a printed business guide or reference manual, these are exactly the tools you’d expect to see discussed – not because they’re trendy, but because they’ve stood the test of real seller use.

If you’re serious about selling on Amazon in the US market, investing in the right research tool at the right time is no longer optional – it’s foundational.