Finding profitable products on Amazon is not about chasing trends or copying what already exists. It’s about understanding market demand, competition dynamics, cost structures, and long-term brand potential – and then making data-backed decisions that reduce risk.

Understanding product profitability is a key milestone in your Amazon selling journey. If you’re new, start with our Amazon Seller Guides hub to get oriented on the full setup and launch process.

At SwanseaAirport, we’ve analyzed thousands of Amazon listings, seller accounts, and marketplace trends. This guide distills that experience into a repeatable, professional product research framework used by serious Amazon sellers – not shortcuts or hype.

Whether you’re launching your first product or expanding an existing brand, this guide will show you how to identify products that sell consistently, scale predictably, and protect your margins.

What Profitable Really Means on Amazon (Beyond Revenue)

Many beginners define profitable products by monthly revenue alone. That’s a mistake.

A truly profitable Amazon product must meet four conditions:

- Sustainable demand (not seasonal hype)

- Manageable competition (room for differentiation)

- Healthy net margins (after all Amazon fees)

- Operational simplicity (low risk, low complexity)

A product making $50.000/month with 8% net margin is often worse than a $15.000/month product at 30% margin – especially once PPC costs rise.

Key Insight: Profitability on Amazon is about defensibility, not just sales velocity.

Before you can assess profitability, you first need to find product opportunities. If you want help starting from idea generation, see our guide on how to find your first product to sell on Amazon.

Step 1: Start With Demand That Already Exists

Amazon is a demand-driven marketplace. You are not creating demand – you are intercepting it.

How to Validate Real Demand

Instead of guessing, look for buyer behavior signals:

- Multiple listings with 300 – 2,000 monthly reviews

- Consistent Best Seller Rank (BSR), not sharp spikes

- Listings with ongoing reviews (weekly or daily)

Avoid:

- Products with sudden ranking jumps (often driven by promotions)

- Viral social media products with unstable demand

Rule of Thumb: If at least 5 sellers are making steady sales without dominating the category, demand is proven.

Step 2: Analyze Competition the Right Way (Not Just Review Counts)

Most guides say “avoid products with too many reviews”. That’s incomplete.

What Actually Signals Weak Competition

Look for listings that show seller weaknesses, such as:

- Poor or incomplete images

- Generic bullet points

- Confusing titles

- Low review ratings (<4.3 stars)

- Frequent complaints about the same issue

These gaps represent opportunities to out-execute, not reasons to avoid the niche.

Red Flags You Should Avoid

- Listings dominated by one brand with 50%+ market share

- Heavy brand recognition (off-Amazon presence)

- Patent-protected designs or trademarks

Professional Tip: You don’t need low competition – you need beat-able competition.

Step 3: Calculate True Profit (Most Sellers Don’t)

Many sellers underestimate costs, especially in the U.S. market.

Include Every Cost:

- Product manufacturing

- Shipping (including peak season surcharges)

- Amazon FBA fees

- Referral fees

- Storage fees

- PPC (assume 15 – 30% of revenue)

- Returns and refunds

- Software tools

Target Benchmarks:

- Minimum net margin: 25%

- Ideal landed cost: range from 25 – 30% of selling price

- Selling price sweet spot: $20 – $60

Lower-priced products struggle with ad costs; higher-priced products face slower conversion.

In addition to profitability data, make sure you validate product ideas before investing to confirm real demand and sales velocity.

Step 4: Avoid High-Risk Product Categories

Even profitable products can fail due to compliance or operational issues.

Categories That Increase Risk:

- Electronics (high returns, certifications)

- Supplements (FDA scrutiny, liability)

- Fragile items (glass, liquids)

- Products for babies or medical use

Beginner-Friendly Categories:

- Home & Kitchen

- Office products

- School supplies

- Pet accessories (non-consumable)

- Sports & outdoors (non-technical)

- Automotive accessories (non-electronic)

Long-term sellers optimize for risk-adjusted profit, not just margin.

Profit margins are only one part of the story – you need a framework to identify winning product characteristics. Learn more in our guide on what makes a winning product.

Step 5: Look for Differentiation Before You Source

The biggest mistake is sourcing before differentiating.

Differentiation Can Be:

- Improved materials

- Added accessories or bundles

- Better sizing or usability

- Clearer instructions

- Premium packaging

- Solving the #1 complaint in reviews

Before contacting suppliers, you should already know:

- What problem customers complain about

- How your version solves it

- Why your product deserves a higher conversion rate

If you cannot explain your differentiation in one sentence, you don’t have one.

Step 6: Validate With Numbers, Not Emotions

Before committing inventory, sanity-check your idea:

Ask yourself:

- Can I realistically rank for page one?

- Can I afford aggressive PPC for 60 – 90 days?

- Can I improve this product again in version 2?

- Can this product support a brand expansion?

Products that pass these questions tend to scale, not just launch.

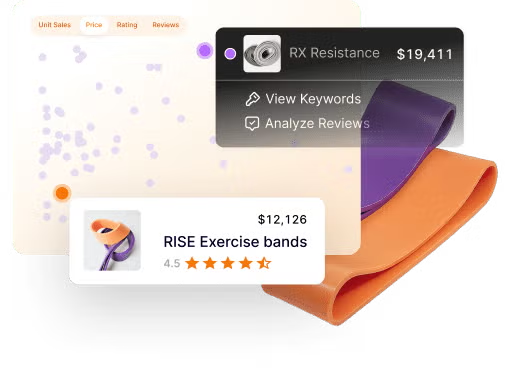

Many sellers leverage advanced software for product screening – see how top tools stack up in our best Amazon product research tools comparison.

Step 7: Think Like a Brand Owner, Not a Product Hunter

The most profitable Amazon sellers don’t chase single products – they build brand ecosystems.

Signs a Product Can Become a Brand:

- Multiple variations possible

- Cross-sell opportunities

- Repeat customer potential

- Off-Amazon audience appeal

A product that leads to 3–5 related SKUs is far more valuable than a standalone winner.

Common Myths About Amazon Product Research

Myth: Low reviews mean easy sales

Reality: Low reviews often mean low demand or poor execution.

Myth: Tools find winning products

Reality: Tools provide data; analysis creates profit.

Myth: Copy what’s selling

Reality: Copycats race to the bottom.

Final Thoughts: Profit Comes From Process, Not Luck

Finding profitable products on Amazon is not about secrets – it’s about structured decision-making.

Sellers who succeed long-term:

- Analyze markets deeply

- Respect costs and risks

- Focus on customer experience

- Build defensible brands

At SwanseaAirport, we believe profitable Amazon businesses are built through clarity, discipline, and execution, not shortcuts.

If you would bookmark, share, or reference this guide later – that’s intentional. This is the same framework used by sellers who treat Amazon as a real business, not a side hustle.