Amazon private label has evolved. What once was a simple “find a product, slap on a logo” model is now a brand-building discipline that rewards sellers who think like operators, not opportunists.

At SwanseaAirport, we work with data-driven sellers who want predictable margins, defensible listings, and long-term exits – not short-lived arbitrage wins. This guide reflects that reality.

This is not a recycled checklist. It’s a step-by-step private label system built on what actually works in today’s Amazon ecosystem – fees, competition, compliance, and all.

What Is Amazon Private Label?

Amazon private label means selling products manufactured by a third party under your own brand, where you control:

- Branding and packaging

- Pricing and positioning

- Listings and marketing

- Customer experience and long-term IP value

Unlike wholesale or retail arbitrage, private label creates an asset, not just cash flow.

Step 1: Validate Demand Before You Validate Products

Most beginners start by browsing products. Experienced sellers start with market demand signals.

What to Look For

Instead of chasing “trending” items, focus on repeatable demand:

- Stable monthly sales (not seasonal spikes only)

- Multiple listings selling consistently – not one runaway winner

- Search intent that reflects problem-solving, not novelty

Pro tip from SwanseaAirport:

If a keyword supports 5 – 10 sellers each doing $15k – $40k/month, that’s often healthier than one seller doing $300k/month.

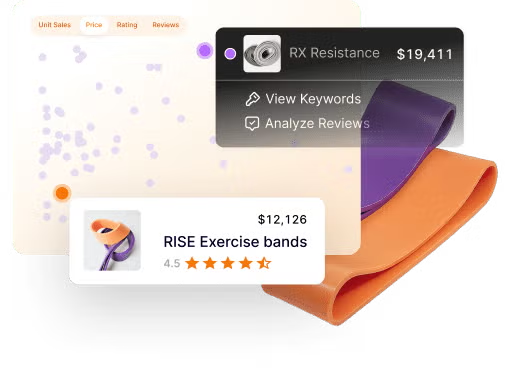

Tools That Actually Matter

- Amazon search results (manual review still matters)

- Helium 10 / Jungle Scout (directional, not absolute)

- Amazon Brand Analytics (once available)

Data is a compass, not a GPS. Human judgment still decides.

Step 2: Apply a Real Product Viability Filter

Not every product with demand should be private labeled.

The SwanseaAirport Product Viability Framework

A strong private label product typically scores well in at least 4 of these 5 areas:

- Margin resilience

Can it survive Amazon fee increases and PPC inflation? - Differentiation potential

Can you improve materials, bundle, size, or usability? - Logistics efficiency

Lightweight, compact, low damage rate - Compliance clarity

No gray-area claims (medical, supplements, kids’ safety) - Review defensibility

Can you realistically compete without review manipulation?

If a product fails badly in two or more areas, walk away – even if the revenue looks attractive.

Step 3: Competitive Analysis That Goes Beyond Reviews

Counting reviews is not enough anymore.

What Serious Sellers Analyze

- Brand strength: Are competitors real brands or generic sellers?

- Listing quality: Weak copy, poor images = opportunity

- Price clustering: Tight price bands signal margin pressure

- Variation strategy: Size, color, bundles used to dominate SERPs

Advanced insight:

If top listings rely heavily on coupons and aggressive PPC, organic demand may be weaker than it appears.

Step 4: Sourcing Suppliers the Smart Way

Alibaba is a starting point – not a sourcing strategy.

How to Vet Suppliers Properly

Beyond “Gold Supplier” badges, ask:

- Do they already manufacture for US brands?

- Can they provide compliance documentation proactively?

- Are they flexible on MOQ for first production runs?

- How do they handle defects and rework?

Request:

- Pre-production samples

- Packaging mockups

- Unit cost breakdowns (product, packaging, tooling)

Rule of thumb:

If a supplier avoids specifics, delays samples, or pushes you to rush -find another one.

Step 5: Build a Brand, Not Just Packaging

Amazon increasingly rewards brand signals, not generic listings.

Foundational Branding Elements

- Brand name with trademark viability

- Clear value proposition (not just “premium quality”)

- Packaging that protects, informs, and differentiates

- Brand Registry readiness from day one

Even minimal branding done well outperforms over-designed but incoherent brands.

Step 6: Calculate True Costs (Most Sellers Don’t)

Your landed cost is not your real cost.

Include These Often-Ignored Expenses

- Amazon referral + FBA fees (post-2024 updates)

- PPC testing budget (launch phase)

- Returns and damaged inventory

- Inspection and compliance costs

- Cash flow timing (manufacturing → ocean → FBA)

Swanseaairport Insight:

If your net margin is under 20% after ads, you don’t have a business – you have a fragile experiment. If you don’t know how to do that you can know more at how to find profitable products on Amazon, that’s the easist way.

Step 7: Launch With a Ranking Strategy, Not Hope

Launching is not about velocity – it’s about controlled relevance.

Smart Launch Principles

- Start with a tight keyword focus

- Optimize conversion rate before scaling traffic

- Use PPC to gather data, not burn cash

- Fix listing issues fast based on early feedback

Avoid tactics that risk account health or long-term trust. Amazon’s enforcement is not getting looser.

Step 8: Optimize for Longevity, Not Just Sales

Sustainable private label brands focus on:

- Review quality, not review count

- Customer feedback loops

- Iterative product improvements

- SKU expansion within the same brand logic

This is how brands become acquisition targets – not just revenue lines.

Common Amazon Private Label Mistakes (And How to Avoid Them)

| Mistake | Why It Fails | Better Approach |

|---|---|---|

| Choosing crowded niches | PPC costs erase margins | Target mid-demand, weak-brand niches |

| Racing to launch | Errors compound | Slow down upfront, speed up later |

| Ignoring compliance | Account risk | Verify before production |

| Copying competitors | No differentiation | Improve customer outcomes |

Is Amazon Private Label Still Worth It in 2026?

Yes – but only for sellers who:

- Think in systems, not shortcuts

- Respect Amazon’s rules and customers

- Invest in brand and operations

Private label is no longer “easy money.” It is real e-commerce, and that’s why it still works.

Final Thoughts from SwanseaAirport

Amazon private label rewards sellers who combine data, discipline, and customer empathy.

If you approach it as a brand builder – not a product flipper – you gain:

- Pricing power

- Long-term defensibility

- Optionality (Walmart, DTC, exits)

That’s the difference between selling on Amazon and building a business with Amazon.