Selling on Amazon isn’t a single business model – it’s an ecosystem of strategies. Three of the most common (and most misunderstood) approaches are wholesale, private label, and arbitrage. Each model can be profitable, but they differ significantly in risk, capital requirements, scalability, brand control, and long‑term defensibility.

Choosing between wholesale, private label, and arbitrage on Amazon can be confusing for new sellers. To understand where these models fit into the bigger process of launching and growing your Amazon business, start with our Amazon Seller Guides hub, a complete roadmap from account setup to scaling profits.

Whether you plan to source private label products or hunt for arbitrage deals, your strategy starts with how to find your first product to sell on Amazon.

This guide is written for U.S. Amazon sellers who want a clear, practical, and experience‑driven comparison, not surface‑level definitions. We’ll break down how each model actually works in 2026, where sellers succeed or fail, and how to choose the right path based on your goals.

Quick comparison: wholesale vs private label vs arbitrage

| Factor | Wholesale | Private Label | Arbitrage (Online/Retail) |

|---|---|---|---|

| Upfront capital | Medium – High | High | Low |

| Speed to first sale | Medium | Slow | Fast |

| Brand ownership | No | Yes | No |

| Amazon competition | Moderate – High | High (but controllable) | Very High |

| Long‑term defensibility | Medium | High | Low |

| Scalability | Medium | High | Low – Medium |

| Typical margin | 10 – 25% | 25 – 45% | 10 – 30% |

| Policy risk | Medium | Low–Medium | High |

What is wholesale on Amazon?

How wholesale really works

Wholesale sellers purchase branded products directly from authorized manufacturers or distributors and resell them on existing Amazon listings. You are not creating a new product – you are competing on price, availability, and operational efficiency.

Example: You open a wholesale account with a U.S. kitchenware brand, purchase inventory in bulk, and sell the brand’s products under the existing ASIN.

Why sellers choose wholesale

- Proven demand (sales history already exists)

- Lower product research risk than private label

- Faster scaling compared to arbitrage

- Easier to get funding once accounts are established

Hidden challenges most guides ignore

- Brand approval barriers: Many brands now restrict Amazon resellers

- Price wars: Competing sellers race to the Buy Box

- Thin margins: Profits depend heavily on volume and cash flow discipline

- Account scrutiny: Invoices must be clean and verifiable

Who wholesale is best for

Wholesale works best for sellers who:

- Have $10,000 – $50,000+ in starting capital

- Are comfortable with B2B sales and negotiations

- Want predictable revenue rather than brand building

- Understand cash‑flow management deeply

- Want to find profitable products on Amazon

Expert insight: Wholesale is less about “finding products” and more about building supplier relationships. Sellers who treat it like a relationship business outperform those who treat it like sourcing.

What is private label on Amazon?

How private label works in practice

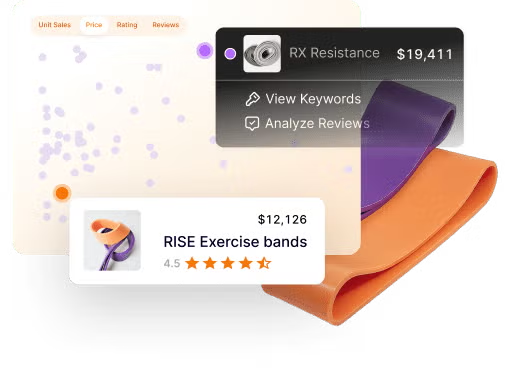

Private label sellers create their own branded products, typically by working with overseas or domestic manufacturers. You control the listing, branding, pricing, and long‑term asset value.

Example: You identify a demand gap in the home fitness category, customize a product, register your brand, and launch under your own trademark.

Why private label attracts serious sellers

- Full control over the listing and brand

- Higher long‑term margins

- Ability to build a sellable business asset

- Access to Brand Registry tools (A+ Content, Brand Analytics, ads)

Real risks new sellers underestimate

- Launch failure risk: Not every product succeeds

- Capital lock‑in: Inventory, branding, and ads tie up cash

- Review velocity challenges: Especially in competitive niches

- IP exposure: Trademarks, patents, and copycats require monitoring

Who private label is best for

Private label suits sellers who:

- Can invest $15,000 – $40,000 per product

- Think long‑term (12 – 36 months)

- Are comfortable with product differentiation and marketing

- Want to build a defensible brand, not just cash flow

Expert insight: Private label success today depends less on finding untapped products and more on execution quality – branding, positioning, and post‑launch optimization.

For a full walkthrough of how the private label model works on Amazon, see our guide on Amazon private label strategy.

What is arbitrage on Amazon?

How arbitrage works

Arbitrage sellers buy products from retail stores or online websites at a discount and resell them on Amazon for a profit.

There are two main types:

- Retail arbitrage: Buying from physical stores (Walmart, Target, clearance aisles)

- Online arbitrage: Buying discounted products from websites

Why arbitrage is popular

- Lowest barrier to entry

- Minimal upfront investment

- Fast learning curve

- Immediate cash flow potential

The downsides many sellers discover late

- Policy risk: High risk of IP complaints or authenticity claims

- Ungated categories: Sudden restrictions can kill listings

- No defensibility: Anyone can sell the same product

- Time‑intensive: Scaling often means more sourcing hours

Who arbitrage is best for

Arbitrage is ideal for sellers who:

- Are starting with under $2,000

- Want to learn Amazon systems quickly

- Prefer flexibility over long‑term stability

- Use it as a stepping stone, not an end goal

Expert insight: Arbitrage is best treated as a training model, not a permanent business foundation.

Whether sourcing wholesale inventory or private label items, many sellers start with platforms like Alibaba – see our detailed guide on finding suppliers on Alibaba for Amazon

Profitability vs sustainability: the real comparison

To decide which model fits your goals, evaluate opportunities using clear product evaluation criteria.

Many sellers ask, Which model is most profitable? The better question is:

Which model aligns with my risk tolerance, capital, and long‑term goals?

- Arbitrage offers fast wins but fragile income

- Wholesale offers stability but limited control

- Private label offers the highest upside with the highest execution risk

The most successful sellers often combine models:

- Arbitrage to learn

- Wholesale to stabilize cash flow

- Private label to build equity

Once you identify potential suppliers, effective negotiation strategies can improve profitability regardless of the business model you choose.

Common myths that hurt new sellers

Myth 1: Private label is dead

Reality: Poorly differentiated private label is dead. Strong brands are thriving.

Myth 2: Wholesale is risk‑free

Reality: Supplier suspensions and price compression are real risks.

Myth 3: Arbitrage is easy money

Reality: It’s operationally demanding and policy‑sensitive.

How to choose the right Amazon business model

Ask yourself:

- How much capital can I realistically risk?

- Do I want cash flow now or equity later?

- Am I comfortable dealing with suppliers or manufacturers?

- How much time can I dedicate weekly?

Decision shortcut:

- Low capital + learning phase → Arbitrage

- Capital + operations mindset → Wholesale

- Brand vision + patience → Private Label

Whether you’re considering arbitrage deals or private label products, it’s smart to validate product ideas before investing to confirm real demand.

Final thoughts from SwanseaAirport

There is no universally “best” Amazon business model – only the best‑fit strategy for your current stage. The sellers who succeed long term are not the ones chasing trends, but the ones building systems, relationships, and defensible advantages.

If you treat Amazon like a real business – not a shortcut – each of these models can work. The key is choosing deliberately, executing professionally, and evolving as your experience grows.

This guide is written by Amazon marketplace researchers and practitioners at SwanseaAirport, drawing on real seller case studies, platform policy analysis, and hands‑on experience across wholesale, private label, and arbitrage models.