Launching a new product on Amazon or Walmart can be highly profitable – but only if demand, competition, and economics align. Too many sellers lose capital by skipping one critical step: product validation.

At SwanseaAirport, we’ve analyzed hundreds of winning and failing listings across Amazon FBA and Walmart Marketplace. The difference between success and sunk costs almost always comes down to how well a product idea is validated before money is committed.

This guide provides a practical, data-driven framework to validate product ideas before you invest in inventory, tooling, or branding – helping you reduce risk while increasing your odds of building a scalable ecommerce business.

What Product Validation Really Means (and What It Doesn’t)

Product validation is not guessing, copying competitors blindly, or relying on “trending” lists alone.

True product validation answers three questions with evidence:

- Do real customers already buy this type of product?

- Can you compete profitably with a differentiated offer?

- Do the unit economics work after all marketplace costs?

If you can’t confidently answer all three, the product is not validated – no matter how exciting the idea sounds.

Step 1: Confirm Real Market Demand (Beyond Surface-Level Metrics)

Start with Search Demand, Not Hype

Search behavior reflects buying intent. Before evaluating competitors, confirm that people are actively searching for the product.

Key indicators:

- Consistent monthly search volume (not just seasonal spikes)

- Multiple related keywords (signals category depth)

- Stable or upward trend over 6 – 12 months

A product with moderate but consistent demand often outperforms “hot” products that spike briefly and fade.

Expert insight: Products with 1,000 – 5,000 monthly searches per core keyword are often easier to rank and defend than hyper-competitive high-volume keywords. If you don’t know to start, you can check this article How to find your first product to sell on Amazon to know how to start.

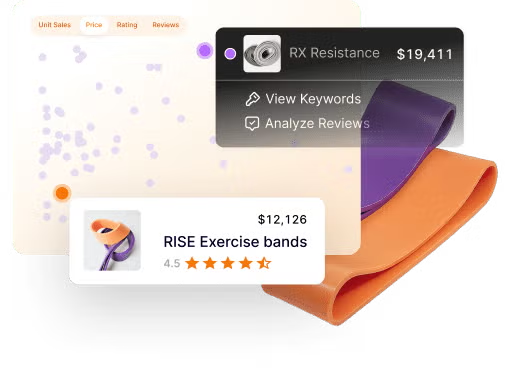

Analyze Revenue, Not Just Sales Rank

Sales rank alone can be misleading. Focus on:

- Estimated monthly revenue per listing

- Revenue distribution across top 10 – 20 listings

- Presence of smaller sellers earning steady sales

A healthy market shows revenue spread, not just one dominant brand taking everything.

Step 2: Evaluate Competitive Pressure Realistically

Count Sellers – Then Qualify Them

Competition is not about how many listings exist – it’s about how strong the existing offers are.

Review:

- Average review count of top 10 listings

- Review velocity (new reviews per month)

- Brand dominance vs reseller presence

- Quality of images, copy, and packaging

A market with:

- 5 – 15 sellers

- Many listings under 500 reviews

- Weak branding or outdated listings

… is often a strong validation signal.

Look for “Lazy Competition” Signals

These are subtle but powerful indicators that opportunity exists:

- Poor image quality or missing lifestyle photos

- Generic bullet points with no differentiation

- Inconsistent sizing, unclear instructions, or confusing variations

- Negative reviews repeating the same complaint

If customers are already telling you what they want improved, validation becomes much easier.

Step 3: Validate Profitability with Conservative Economics

Many products look profitable – until fees are applied.

Calculate True Landed Cost

Include:

- Product manufacturing

- Packaging and labeling

- Shipping (international + domestic)

- Import duties (if applicable)

- Prep and inspection fees

Then subtract:

- Amazon or Walmart referral fees

- Fulfillment fees

- Advertising costs (PPC)

- Returns and damage allowances

Rule of thumb: Aim for 30 – 40% net margin before scaling ads. Anything less leaves little room for error.

Test Pricing Elasticity

Ask:

- Are competitors clustered tightly on price?

- Do premium listings still sell?

- Is there room to charge more with better branding or bundles?

If a $2 price drop wipes out profits, the product may not be resilient enough for long-term success.

Step 4: Use Reviews as Free Market Research

Customer reviews are one of the most underutilized validation tools.

Analyze 1 – 3 Star Reviews for Patterns

Look for:

- Repeated complaints about durability, sizing, or usability

- Missing accessories or unclear instructions

- Packaging or shipping issues

If problems are fixable, the product may be better validated, not worse.

Validate Differentiation Opportunities

Ask yourself:

- Can we improve materials, design, or instructions?

- Can we bundle complementary items?

- Can branding solve trust issues customers mention?

Validation is strongest when customer pain points align with your ability to fix them.

Step 5: Check Platform-Specific Risks (Often Overlooked)

A product can be validated by demand – but killed by policy or logistics.

Before investing, confirm:

- No restricted or gated category issues

- No IP, trademark, or design patent risks

- Acceptable return rates for the category

- Reasonable shipping size and weight

Products with high return rates or policy gray areas are rarely worth the risk, even if demand is strong.

Step 6: Test Before You Scale (Real-World Validation)

The most reliable validation happens before full inventory commitment.

Smart testing methods include:

- Small MOQ orders

- Limited PPC test campaigns

- Walmart Marketplace tests before Amazon scale

- Pre-orders or soft launches

Even modest real-world data beats assumptions every time.

Common Validation Mistakes That Cost Sellers Money

Avoid these traps:

- Chasing viral or trending products without historical data

- Copying top sellers without differentiation

- Ignoring negative reviews

- Overestimating margins by underestimating ad costs

- Validating demand but not operational complexity

Experienced sellers fail less not because they find better ideas – but because they disqualify bad ones faster.

A Simple Product Validation Checklist

Before investing, you should be able to say “yes” to the following:

- Consistent search demand exists

- Multiple sellers earn revenue (not just one brand)

- Reviews reveal solvable problems

- Net margins exceed 30% conservatively

- Platform and policy risks are manageable

- Differentiation is clear and defensible

If even one box is uncertain, slow down and re-evaluate.

Final Thoughts: Validation Is a Skill, Not a Shortcut

Product validation is not about eliminating risk – it’s about controlling it with evidence.

At SwanseaAirport, we’ve seen that sellers who master validation:

- Launch fewer products

- Waste less capital

- Scale faster with confidence

- Build brands instead of chasing trends

If you want to succeed on Amazon or Walmart long-term, treat product validation as a core business discipline, not a checklist you rush through.

About SwanseaAirport

SwanseaAirport is a digital commerce brand providing tools, guides, product reviews, and expert insights to help sellers build profitable, sustainable businesses on Amazon and Walmart marketplaces.